Credit cards are revolving credit accounts that allow you to borrow money repeatedly up to a set limit, repay what you’ve spent, and borrow again, creating a continuous cycle of credit access that differs fundamentally from fixed-term loans. In 2025, Americans hold over 500 million credit card accounts, making these financial tools one of the most widely used yet frequently misunderstood instruments in personal finance.

Understanding how credit cards work isn’t just about swiping plastic. It’s about comprehending the math behind money, the interest calculations, utilization ratios, and fee structures that can either support your wealth building or drain your resources through compound costs.

This guide breaks down the mechanics, reward structures, and genuine risks of credit cards with data-driven insights and evidence-based explanations. Whether you’re applying for your first card or optimizing a portfolio of rewards cards, you’ll learn the financial literacy fundamentals that turn credit cards from potential traps into strategic tools.

Key Takeaways

- Credit cards function as revolving credit lines that reset monthly, unlike installment loans with fixed repayment schedules

- Paying your statement balance in full by the due date avoids all interest charges through the grace period mechanism

- Credit utilization below 30% (ideally below 10%) optimizes your credit score impact and demonstrates responsible credit management

- APR converts to daily interest rates that compound on unpaid balances, making minimum payments a mathematically expensive choice

- Different card types serve specific financial goals—rewards cards for optimizers, secured cards for credit building, balance transfer cards for debt consolidation

What Are Credit Cards?

A credit card is a payment tool that provides access to a revolving line of credit from a financial institution. When you use a credit card, you’re borrowing money with the promise to repay it, either immediately (avoiding interest) or over time (incurring interest charges).

The fundamental mechanics work like this:

The card issuer (typically a bank) approves you for a credit limit say $5,000. You can spend up to that amount, repay what you’ve borrowed, and the available credit replenishes. This differs from an installment loan, where you receive a lump sum once and make fixed payments until the debt is eliminated.

Credit cards versus debit cards:

Debit cards withdraw money directly from your checking account. You’re spending your own funds. Credit cards let you spend the bank’s money, which you must repay. This distinction creates both opportunity (building credit history, earning rewards) and risk (accumulating high-interest debt).

Credit cards versus personal loans:

Personal loans provide a fixed amount with a predetermined repayment schedule and end date. Credit cards offer ongoing access to credit with flexible repayment options, but this flexibility comes with higher interest rates if you carry balances month to month.

The revolving nature of credit cards makes them powerful for managing cash flow and maximizing rewards, but only when used with discipline and understanding of personal finance fundamentals.

Insight: Credit cards are neutral tools. The math behind money determines whether they build or destroy wealth—interest rates, payment timing, and utilization percentages create dramatically different financial outcomes.

How Credit Cards Work Behind the Scenes

Every credit card transaction involves four key players working in coordinated sequence: the cardholder (you), the merchant, the card network (Visa, Mastercard, American Express, Discover), and the issuing bank.

The transaction flow:

- Authorization: You swipe, insert, or tap your card at checkout. The merchant’s payment processor sends a request through the card network to your issuing bank, asking: “Does this account have sufficient available credit?”

- Approval or decline: Your bank checks your credit limit and account status, then sends an approval or decline message back through the network in seconds.

- Settlement: At the end of each business day, merchants submit batches of approved transactions. The card network facilitates fund transfers from issuing banks to merchant accounts, minus interchange fees.

- Billing: Your issuing bank adds the transaction to your account balance and includes it in your monthly statement.

Why this matters for you:

Understanding this process explains why credit card processing includes fees that merchants pay (1.5-3.5% of each transaction). These fees fund the rewards programs, fraud protection, and infrastructure that make credit cards valuable.

The role of interest:

Card issuers make money through three primary channels:

- Interest charges on carried balances (the largest revenue source)

- Interchange fees from merchants

- Cardholder fees (annual fees, late fees, foreign transaction fees)

According to the Consumer Financial Protection Bureau, credit card companies collected over $120 billion in interest and fees from U.S. consumers in 2024. This demonstrates why issuers actively encourage balance-carrying behavior through minimum payment structures.

The grace period advantage:

Most credit cards offer a grace period, typically 21-25 days from the statement closing date to the payment due date. If you pay your statement balance in full by the due date, you pay zero interest on purchases. This creates a float period where you use the bank’s money interest-free.

Takeaway: The credit card system is designed to profit from cardholders who carry balances. Understanding the authorization-settlement-billing cycle helps you exploit the grace period while avoiding the interest trap.

For a broader context, see our full guide on How credit cards work framework.

Credit Card Interest Explained

APR (Annual Percentage Rate) represents the yearly cost of borrowing on your credit card, but credit card interest actually compounds daily, making the effective cost higher than the stated APR for carried balances.

How APR converts to daily interest:

Credit card companies calculate interest using the daily periodic rate (DPR):

DPR = APR ÷ 365

For an 18.99% APR:

- DPR = 18.99% ÷ 365 = 0.052% per day

The daily compounding effect:

Each day you carry a balance, the issuer multiplies your balance by the DPR and adds that interest to your balance. The next day, you pay interest on the new, slightly higher balance. This is compound interest working against you.

Example calculation:

- Starting balance: $1,000

- APR: 18.99%

- DPR: 0.052%

- Daily interest: $1,000 × 0.00052 = $0.52

- Day 2 balance: $1,000.52

- Day 2 interest: $1,000.52 × 0.00052 = $0.52

- After 30 days: ~$15.83 in interest charges

Over a full year with no payments, that $1,000 balance would grow to approximately $1,208.50—an effective rate slightly higher than the stated 18.99% due to daily compounding.

Why minimum payments trap borrowers:

Minimum payments typically equal 1-3% of your balance or $25-35, whichever is greater. On a $5,000 balance at 18.99% APR with a 2% minimum payment:

- Minimum payment: $100

- Interest portion: ~$79

- Principal reduction: ~$21

At this rate, it would take over 30 years to pay off the balance and cost more than $11,000 in total interest—more than double the original amount borrowed.

The credit card interest calculator demonstrates these scenarios with precise mathematics, showing why paying only minimums represents one of the most expensive borrowing decisions in consumer finance.

Variable versus fixed APR:

Most credit cards carry variable APRs tied to the Prime Rate (currently around 8.5% in 2025). When the Federal Reserve adjusts interest rates, your APR adjusts accordingly, typically within one or two billing cycles.

Fixed APRs can change, too; issuers must simply provide 45 days’ notice before increasing rates on existing balances.

Purchase APR versus other APRs:

Credit cards often have different APRs for:

- Purchases: Standard rate (15-25% typical range)

- Balance transfers: Sometimes, lower promotional rates

- Cash advances: Usually higher (25-30%)

- Penalty APR: Applied after missed payments (up to 29.99%)

Data point: According to Federal Reserve data, the average credit card APR reached 22.8% in early 2025, the highest level in over three decades, making understanding credit card interest more critical than ever.

Statement Balance vs Current Balance

The difference between statement balance and current balance determines whether you pay interest or avoid it entirely—yet many cardholders don’t understand this crucial distinction.

Statement balance:

This is the total amount you owed when your billing cycle closed. It appears on your monthly statement and represents all transactions posted during that specific billing period (typically 28-31 days).

Current balance:

This is what you owe right now, including all transactions since your last statement closed. It changes daily as you make new purchases or payments.

Why this matters for avoiding interest:

To maintain your grace period and pay zero interest, you must pay the statement balance in full by the due date. Paying only the current balance or a partial amount triggers interest charges on the unpaid portion.

The billing cycle timeline:

- Day 1-30: Billing cycle period (transactions accumulate)

- Day 30: Statement closing date (statement balance is set)

- Day 31-51: Grace period (typically 21-25 days)

- Day 51: Payment due date

Example scenario:

- Statement closing date: March 15

- Statement balance: $1,500

- Payment due date: April 9

- Current balance on April 1: $1,800 (includes $300 in new purchases after March 15)

To avoid interest: Pay at least $1,500 (the statement balance) by April 9. The $300 in new purchases will appear on your next statement with a new grace period.

Common misconception:

Many cardholders believe paying the current balance is necessary to avoid interest. This leads to overpayment or confusion. The statement balance is the critical number.

When the grace period disappears:

If you carry any balance from one statement to the next, you lose the grace period. All new purchases begin accruing interest immediately from the transaction date until you pay two consecutive statement balances in full.

Restoring the grace period:

To regain interest-free treatment on purchases:

- Pay the current statement balance in full

- Pay the next statement balance in full

- The grace period is reinstated on the following billing cycle

The statement balance vs current balance distinction represents one of the most valuable pieces of financial literacy for credit card users. This single concept can save thousands in interest charges over a lifetime.

Key principle: Statement balance determines interest charges. Current balance reflects real-time debt. Always reference your statement balance when making payments to maintain interest-free status.

For a broader context, deep dive into our grace period guide.

Credit Card Utilization and Your Credit Score

Credit utilization, the percentage of available credit you’re using, accounts for approximately 30% of your FICO credit score calculation, making it the second most influential factor after payment history.

The utilization formula:

Utilization Rate = (Total Credit Card Balances ÷ Total Credit Limits) × 100

Example:

- Card 1: $500 balance, $2,000 limit

- Card 2: $1,000 balance, $5,000 limit

- Card 3: $0 balance, $3,000 limit

- Total balances: $1,500

- Total limits: $10,000

- Utilization: ($1,500 ÷ $10,000) × 100 = 15%

Optimal utilization ranges:

Research from credit scoring agencies indicates:

- Below 10%: Excellent (highest score impact)

- 10-30%: Good (positive score impact)

- 30-50%: Fair (neutral to slight negative impact)

- 50-70%: Poor (significant negative impact)

- Above 70%: Very poor (severe negative impact)

Per-card versus overall utilization:

Credit scoring models evaluate both:

- Overall utilization: Total balances across all cards divided by total limits

- Per-card utilization: Individual card balance divided by that card’s limit

Maxing out one card while keeping others at zero can hurt your score even if overall utilization appears reasonable.

Timing effects:

Most issuers report your balance to credit bureaus on your statement closing date, not your payment due date. This creates a strategic opportunity:

Strategy for score optimization:

- Make a payment before your statement closes to reduce the reported balance

- This lowers your utilization without requiring you to pay early or lose grace period benefits

Example timing strategy:

Statement closes on the 15th, payment due on the 10th of the following month:

- April 10: Make a payment to reduce the balance

- April 15: Statement closes with lower balance (this gets reported)

- May 10: Pay the remaining statement balance in full

The utilization paradox:

Zero utilization doesn’t maximize scores. Credit scoring models prefer to see some activity. Optimal utilization shows you use credit responsibly without depending on it heavily.

Impact magnitude:

Reducing utilization from 80% to 30% can increase credit scores by 50-100 points, according to FICO data. This makes credit card utilization one of the fastest ways to improve credit scores.

Increasing credit limits:

Requesting credit limit increases (without new hard inquiries) or opening new cards increases your total available credit, automatically lowering utilization if balances remain constant.

Calculation example:

- Current: $3,000 balance, $10,000 total limits = 30% utilization

- After limit increase: $3,000 balance, $15,000 total limits = 20% utilization

- Score improvement without paying down any debt

Action item: Monitor utilization monthly. Keep individual cards below 30% and overall utilization below 10% for optimal credit score performance. Use balance alerts to track spending throughout the month.

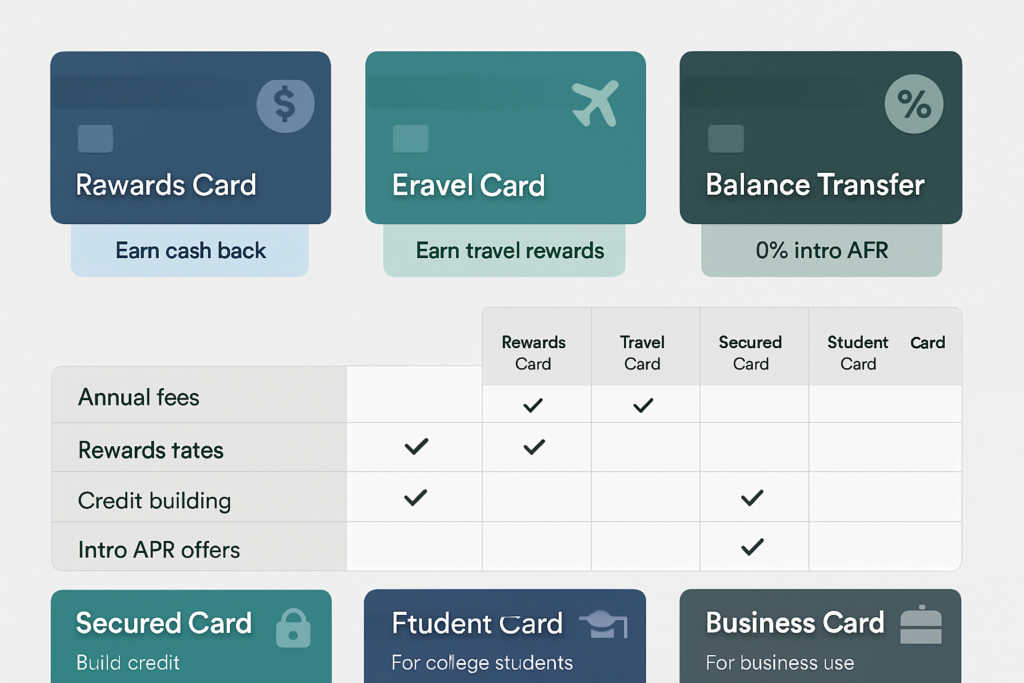

Types of Credit Cards

Credit cards serve different financial purposes. Matching card type to your specific goals maximizes benefits while minimizing costs and risks.

Rewards Credit Cards

Rewards cards offer cash back, points, or miles on purchases, effectively providing a discount on spending when used strategically.

Cash back structures:

- Flat-rate: 1.5-2% on all purchases (simple, no category tracking)

- Tiered: Higher rates on specific categories (3-5% on groceries, gas, dining)

- Rotating: 5% on quarterly categories (requires activation and tracking)

Points and miles:

These programs assign point values to purchases, redeemable for travel, merchandise, or statement credits. Value per point varies (typically 0.5-2 cents), making the redemption strategy critical.

The rewards math:

A 2% cash back card on $2,000 monthly spending:

- Monthly rewards: $40

- Annual rewards: $480

If the card charges a $95 annual fee:

- Net annual benefit: $385

Break-even analysis:

Annual fee ÷ Rewards rate = Required spending

For a $95 fee with 2% cash back:

$95 ÷ 0.02 = $4,750 annual spending needed to break even

Common rewards card features:

- Sign-up bonuses (spend $3,000 in 3 months, earn 50,000 points)

- Category multipliers (3x points on dining)

- Travel protections (trip cancellation, rental car insurance)

- Purchase protections (extended warranty, price protection)

Detailed analysis available in rewards credit cards explained.

Warning: Rewards cards typically require excellent credit (720+ FICO) and carry higher APRs (18-25%). Only valuable if you pay statement balances in full each month.

Balance Transfer Credit Cards

Balance transfer cards offer promotional 0% APR periods (12-21 months) on balances transferred from other cards, creating opportunities for debt consolidation and interest savings.

The mechanics:

- Apply for a balance transfer card

- Request transfer of existing card balances

- Pay balance transfer fee (typically 3-5%)

- Enjoy 0% APR for the promotional period

- Pay off the balance before the promotional period ends

Cost-benefit calculation:

Existing balance: $5,000 at 22% APR

Balance transfer card: 0% APR for 18 months, 3% transfer fee

- Transfer fee: $150

- Interest saved over 18 months: ~$1,650

- Net savings: $1,500

Critical requirements:

- Must pay off balance before promotional period ends

- New purchases often don’t receive 0% rate

- Missing a payment can void the promotional rate

- Requires good to excellent credit for approval

Strategic use case:

Balance transfers work best for consolidating high-interest debt with a concrete repayment plan, not as a way to continue accumulating debt.

Payment calculation:

$5,000 balance + $150 fee = $5,150 total

18-month promotional period

Required monthly payment: $5,150 ÷ 18 = $286.11

Additional details on balance transfers are explained.

Secured Credit Cards

Secured cards require a refundable security deposit that serves as your credit limit, making them accessible to those with limited or damaged credit history.

How they work:

- Deposit $500 → Receive $500 credit limit

- Use the card like any credit card

- Make on-time payments to build credit

- After 6-12 months of responsible use, many issuers upgrade to an unsecured card and return the deposit

Credit-building effectiveness:

Secured cards report to all three credit bureaus (Experian, Equifax, TransUnion), building payment history and establishing credit utilization—the two most important credit score factors.

Typical features:

- No credit check for approval (deposit eliminates issuer risk)

- Lower fees than unsecured cards for bad credit

- Graduation path to unsecured cards

- Same credit-building power as unsecured cards

Cost considerations:

- Annual fees: $0-$49

- Security deposit: $200-$2,500 (your choice, sets credit limit)

- APR: 20-26% (irrelevant if you pay the statement balance in full)

Optimal strategy:

Use a secured card for small recurring charges (e.g., Netflix, Spotify), set up autopay for your statement balance, and let it build your credit history passively for 6-12 months.

A comprehensive guide is available explaining secured credit cards.

Other Specialized Card Types

Student credit cards:

- Designed for college students with limited credit history

- Lower credit limits ($500-$1,000)

- Basic rewards programs

- Educational resources and credit monitoring

Business credit cards:

- Separate business and personal expenses

- Higher credit limits

- Business-specific rewards (office supplies, shipping)

- May not report to personal credit bureaus

Store credit cards:

- Usable only at specific retailers

- Higher rewards at that retailer (5-10%)

- Lower credit requirements

- Higher APRs (25-30%)

- Limited value unless you’re a frequent customer

Premium travel cards:

- High annual fees ($450-$695)

- Extensive travel benefits (airport lounge access, travel credits)

- Premium rewards rates

- Concierge services

- Requires significant spending to justify fees

Selection principle: Choose cards that align with your credit profile, spending patterns, and financial goals. The “best” card varies by individual circumstances and discipline level.

Credit Card Fees You Should Actually Care About

Credit card fees can significantly impact the value proposition of any card. Understanding which fees matter and how to avoid them protects your wealth-building efforts.

Annual Fees

Range: $0-$695+

Value assessment:

Annual fees only make sense when rewards and benefits exceed the fee cost. Premium cards justify fees through:

- Travel credits ($300 annual travel credit effectively reduces a $550 fee to $250)

- Airport lounge access (value: $400-600 annually)

- High rewards rates (3-5x points on categories)

- Premium benefits (trip insurance, concierge, hotel status)

Break-even formula:

(Annual Fee – Annual Credits) ÷ Effective Rewards Rate = Required Spending

Example: $95 fee, no credits, 2% effective rewards rate

$95 ÷ 0.02 = $4,750 required annual spending

No-annual-fee alternatives:

Many excellent cards charge $0 annually, offering 1.5-2% cash back with no spending requirements to justify the card’s existence in your wallet.

Late Payment Fees

Range: $30-$41 (depending on violation frequency)

Impact beyond the fee:

- Penalty APR activation (up to 29.99%)

- Credit score damage (payment history = 35% of FICO score)

- Loss of promotional APR rates

- Potential account closure

Avoidance strategy:

Set up automatic minimum payments as a safety net, then manually pay statement balances in full before due dates. This prevents late fees even if you forget a payment.

One-time forgiveness:

Most issuers waive the first late fee if you call and request forgiveness, especially if you have a strong payment history. This courtesy typically applies once per year.

Foreign Transaction Fees

Standard rate: 3% of transaction amount

Impact calculation:

$3,000 in international spending × 3% = $90 in fees

Cards without foreign transaction fees:

Many travel rewards cards and even some no-annual-fee cards waive foreign transaction fees entirely. If you travel internationally or make foreign currency purchases online, choosing a no-foreign-fee card is essential.

When it matters:

- International travel

- Online purchases from foreign merchants

- Any transaction processed in foreign currency

Cash Advance Fees

Fee structure: 3-5% of the advance amount or $10 minimum

Why cash advances are expensive:

- Immediate interest accrual (no grace period)

- Higher APR (25-30% typical)

- Separate cash advance fee

- Interest compounds daily from the transaction date

Example cost:

$500 cash advance with 5% fee and 28% APR:

- Immediate fee: $25

- Daily interest rate: 0.077%

- Interest after 30 days: ~$11.50

- Total cost for 30 days: $36.50 (7.3% effective rate)

Alternatives:

- ATM withdrawal from checking account

- Personal loan

- Paycheck advance apps

- Emergency fund (the optimal solution)

Balance Transfer Fees

Standard rate: 3-5% of the transferred amount

Strategic consideration:

A 3% fee to access 0% APR for 18 months often makes financial sense when consolidating high-interest debt, but only with a concrete repayment plan.

Calculation:

$10,000 balance at 22% APR

Transfer to 0% card with 3% fee

- Transfer fee: $300

- Interest saved over 18 months: ~$3,300

- Net benefit: $3,000

Fees That Don’t Matter (Usually)

Returned payment fee: Avoidable with proper account management

Over-limit fee: Rare since the 2010 Credit CARD Act; must opt-in

Card replacement fee: Usually waived for standard replacement

Paper statement fee: Easily avoided with electronic statements

Comprehensive fee analysis available at credit card fees explained.

Cost principle: Fees represent guaranteed costs. Rewards represent potential benefits. Optimize by minimizing avoidable fees while maximizing rewards through strategic card selection and disciplined usage.

Common Credit Card Mistakes That Cost the Most

Understanding the math behind common credit card errors reveals why certain behaviors destroy wealth while others build it.

Mistake #1: Carrying Balances to “Build Credit”

The myth: You need to carry a balance and pay interest to build credit.

The reality: Payment history and credit utilization build credit. Interest payments add zero value to your credit score.

The cost:

$2,000 average balance at 20% APR = $400 annual interest

Over 10 years = $4,000 in unnecessary interest payments

Invested at 8% annual return = $6,066 opportunity cost

Correct approach: Pay the statement balance in full monthly. Your credit report shows account activity and on-time payments regardless of whether you pay interest.

Mistake #2: Making Only Minimum Payments

The trap: Minimum payments feel manageable, but maximize interest costs and extend debt indefinitely.

The mathematics:

$5,000 balance at 18% APR with 2% minimum payment:

- Time to pay off: 30+ years

- Total interest paid: $11,680

- Total amount paid: $16,680

Same balance with $200 monthly payment:

- Time to pay off: 31 months

- Total interest paid: $1,235

- Total amount paid: $6,235

Savings from strategic payment: $10,445

Mistake #3: Maxing Out Credit Cards

The damage:

High utilization (above 80%) can drop credit scores by 100+ points, affecting:

- Future credit card approvals

- Auto loan rates

- Mortgage rates

- Rental applications

- Insurance premiums (in some states)

Example impact:

$300,000 mortgage at 7% vs 7.5% (due to lower credit score):

- 7% rate: $1,996 monthly payment

- 7.5% rate: $2,098 monthly payment

- Difference: $102/month or $36,720 over 30 years

Mistake #4: Ignoring Statement Closing Dates

The oversight: Making purchases right before statement closing dates creates high reported utilization even if you pay in full.

The fix:

Time for large purchases right after the statement closing. They appear on the next statement, giving you 45-55 days before the balance reports to credit bureaus.

Strategic timing:

Statement closes on the 15th:

- Purchase $3,000 item on the 14th → High utilization reported

- Purchase $3,000 item on the 16th → Doesn’t report for 30 days

Mistake #5: Closing Old Credit Card Accounts

The consequences:

Closing accounts reduces total available credit (increasing utilization) and can reduce average account age—both negatively impact credit scores.

Example:

Before closing:

- Total limits: $20,000

- Balances: $4,000

- Utilization: 20%

After closing $5,000 limit card:

- Total limits: $15,000

- Balances: $4,000

- Utilization: 26.7%

Better approach: Keep old cards active with small recurring charges (streaming service) on autopay. This maintains credit history and available credit without requiring active management.

Mistake #6: Applying for Too Many Cards Too Quickly

The impact:

Each application triggers a hard inquiry (typically -5 points per inquiry) and reduces average account age when approved.

Velocity concerns:

Multiple applications within 6 months signal financial stress to lenders, potentially leading to denials even with good credit scores.

Strategic approach:

Space applications 3-6 months apart. Research approval requirements before applying. Consider pre-qualification tools that use soft inquiries.

Mistake #7: Using Rewards Cards While Carrying Balances

The math doesn’t work:

2% cash back rewards with 20% APR on carried balances:

- Rewards earned: 2%

- Interest paid: 20%

- Net cost: -18%

The principle: Interest costs always exceed the rewards and benefits. Rewards cards only create value when used with zero interest charges.

Mistake #8: Ignoring Card Benefits

Unused value:

Premium cards offer benefits many cardholders never use:

- Trip cancellation insurance

- Purchase protection

- Extended warranties

- Cell phone insurance

- Rental car coverage

- Price protection

Example: Paying $35/day for rental car insurance when your card provides it free represents $245 in wasted money on a week-long rental.

Risk management: Credit card mistakes compound over time. A single error (carrying balances, missing payments) can cost thousands in interest and tens of thousands in opportunity cost when considering alternative uses for those funds.

How to Use Credit Cards Responsibly (Simple Rules)

Responsible credit card use follows evidence-based principles that align incentives, automate good behavior, and eliminate emotional decision-making.

Rule #1: Pay Statement Balance in Full Monthly

The foundation: This single rule eliminates interest charges, maintains grace periods, and keeps credit card use cost-free (except annual fees).

Implementation:

- Review the statement when it arrives

- Verify all charges are legitimate

- Pay the full statement balance before the due date

- Never pay just the minimum or current balance

Automation option: Set up autopay for statement balance (not minimum payment). This guarantees you never pay interest or late fees, though you should still review statements for fraud.

Rule #2: Keep Utilization Below 30% (Ideally Below 10%)

The practice:

Monitor balances throughout the month. If approaching 30% of any card’s limit, either:

- Make a mid-cycle payment

- Switch to a different card

- Use debit or cash for remaining purchases

Calculation:

$5,000 credit limit × 30% = $1,500 maximum balance

$5,000 credit limit × 10% = $500 optimal balance

Monitoring tools:

- Card issuer mobile apps (real-time balance tracking)

- Balance alerts at 25% utilization

- Weekly balance reviews

Rule #3: Automate Everything Possible

Automation eliminates human error:

- Autopay: Set for statement balance to prevent late payments

- Recurring charges: Put subscriptions on credit cards for consistent reporting

- Balance alerts: Receive notifications at utilization thresholds

- Due date reminders: Set calendar alerts 3 days before due dates

The behavioral advantage: Automation removes willpower from the equation. You can’t forget what’s handled automatically.

Rule #4: Match Cards to Spending Patterns

Strategic alignment:

Use the card that maximizes rewards for each purchase category:

- Groceries → 3% grocery card

- Gas → 3% gas card

- Dining → 4% dining card

- Everything else → 2% flat-rate card

Complexity consideration:

More cards = higher rewards but increased complexity. Find your personal balance between optimization and simplicity.

Minimum effective approach:

Two cards cover most optimization:

- Category-specific card (3-5% on rotating or fixed categories)

- Flat-rate card (1.5-2% on everything else)

Rule #5: Treat Credit Cards Like Debit Cards

The mental model:

Only charge what you can afford to pay from your checking account immediately. Credit cards should be payment methods, not borrowing tools (except for strategic 0% APR promotions with repayment plans).

Budget integration:

Track credit card spending against budget categories in real-time. When you charge $100 for groceries, mentally deduct $100 from your grocery budget immediately.

Cash flow timing:

Credit cards provide 25-55 days of float between purchase and payment. Use this for cash flow management, not to spend money you don’t have.

Rule #6: Review Statements Monthly

Fraud detection:

Reviewing every transaction catches unauthorized charges quickly, limiting liability and preventing ongoing fraud.

Spending awareness:

Monthly reviews reveal spending patterns, category trends, and opportunities for budget optimization.

Verification checklist:

- All charges are legitimate

- All returns/refunds posted correctly

- No unexpected fees

- Rewards posted as expected

- Statement balance matches expectations

Rule #7: Understand Your Card’s Terms

Critical knowledge:

- APR (even if you never pay it)

- Annual fee and renewal date

- Rewards structure and redemption options

- Benefits (insurance, protections)

- Foreign transaction fees

- Grace period terms

Document location: Card terms are in the “Pricing and Terms” disclosure, typically available in your online account.

Rule #8: Build an Emergency Fund First

The safety net:

Credit cards should never serve as emergency funds. Interest rates (18-25%) make them expensive emergency options.

Priority sequence:

- Build $1,000 emergency fund (cash)

- Get employer 401(k) match

- Pay off high-interest debt

- Build a 3-6 months emergency fund

- Optimize credit card rewards

Why this matters: Financial stress leads to credit card dependency. An emergency fund breaks this cycle, allowing you to use cards strategically rather than desperately.

Implementation checklist: Print these rules. Review monthly. Adjust as needed. Responsible credit card use isn’t complicated—it’s disciplined execution of simple principles aligned with personal finance basics.

Credit Card Tools and Calculators That Help

Data-driven credit card management requires quantitative tools that reveal the math behind money and support evidence-based decision-making.

Interest Cost Calculators

Purpose: Calculate total interest costs and payoff timelines for different payment scenarios.

Key inputs:

- Current balance

- APR

- Monthly payment amount

Valuable insights:

- Total interest paid over the life of the debt

- Payoff timeline

- Impact of additional payments

- Comparison of minimum vs. strategic payments

The credit card interest calculator demonstrates how small payment increases create dramatic interest savings through compound effect reduction.

Example output:

$10,000 balance at 19.99% APR:

- Minimum payment (2%): 447 months, $18,560 interest

- $300/month: 47 months, $3,950 interest

- Savings: $14,610 and 400 months

Balance Transfer Calculators

Purpose: Determine whether balance transfer offers create genuine savings after fees.

Calculation factors:

- Current balance and APR

- Transfer fee percentage

- Promotional APR period

- Post-promotional APR

- Monthly payment capability

Decision framework:

Transfer makes sense when:

(Interest saved during promotional period) > (Transfer fee + opportunity cost)

The balance transfer calculator quantifies net savings and required monthly payments to eliminate debt before promotional periods end.

Rewards Value Calculators

Purpose: Compare rewards programs and determine optimal card usage strategies.

Considerations:

- Annual spending by category

- Rewards rates per category

- Annual fees

- Redemption values (points/miles vs. cash back)

Output: Net annual rewards value after fees, revealing which cards provide genuine value for your specific spending patterns.

Credit Utilization Trackers

Purpose: Monitor utilization across all cards and receive alerts before exceeding optimal thresholds.

Features:

- Real-time utilization percentages

- Per-card and overall utilization

- Alerts at customizable thresholds (10%, 30%)

- Historical utilization trends

Strategic value: Prevents utilization-driven credit score drops through proactive monitoring.

Payment Optimization Tools

Purpose: Determine optimal payment allocation when managing multiple card balances.

Strategy comparison:

- Avalanche method: Pay the highest APR first (mathematically optimal)

- Snowball method: Pay the smallest balance first (psychologically motivating)

- Hybrid approaches: Balance math and motivation

Calculation: Total interest saved and payoff timeline for each strategy.

Annual Fee Break-Even Calculators

Purpose: Determine the required spending to justify annual fees through rewards.

Formula:

Break-even spending = Annual fee ÷ (Premium card rewards rate – Alternative card rewards rate)

Example:

Card with $95 fee earning 2% vs. no-fee card earning 1.5%:

$95 ÷ (0.02 – 0.015) = $19,000 annual spending required

Credit Card Comparison Tools

Purpose: Side-by-side comparison of card features, rewards, fees, and benefits.

Comparison factors:

- APR ranges

- Annual fees

- Rewards structures

- Sign-up bonuses

- Benefits and protections

- Credit requirements

Decision support: Quantitative comparison removes emotional decision-making and reveals optimal card choices for specific financial situations.

Tool principle: Credit card decisions involve complex mathematics—interest compounding, utilization ratios, rewards optimization. Calculators transform these complexities into clear numbers that support rational decision-making.

How Credit Cards Fit Into Your Bigger Financial Plan

Credit cards represent one component of a comprehensive financial strategy—powerful when used correctly, destructive when mismanaged or overemphasized.

The hierarchy of financial priorities:

- Cash flow management: Spend less than you earn

- Emergency fund: 3-6 months’ expenses in liquid savings

- High-interest debt elimination: Pay off credit card balances, payday loans

- Retirement contributions: Capture employer matches, fund IRAs

- Credit optimization: Build credit history, maximize rewards

- Wealth building: Invest in diversified portfolios, real estate, and business

Credit cards’ role in this framework:

Payment efficiency tool: Credit cards provide transaction convenience, fraud protection, and rewards for spending you’d do anyway. They shouldn’t change spending behavior—only the payment method.

Credit building instrument: Responsible credit card use establishes payment history (35% of FICO score) and manages utilization (30% of FICO score), creating access to favorable rates on mortgages, auto loans, and other credit products.

Cash flow management: The 25-55 day float between purchase and payment helps manage irregular income or timing mismatches between expenses and paychecks, but only when you have the funds to pay statement balances in full.

Rewards optimization: Strategic card selection and usage can return 1.5-3% of spending, representing $300-600 annually on $20,000 in spending—meaningful but not life-changing amounts.

What credit cards are NOT:

Emergency funds: 20%+ APRs make credit cards expensive emergency options

Income supplements: Carrying balances to fund lifestyle creates debt spirals

Investment capital: Never invest borrowed money from credit cards

Status symbols: Premium cards should provide value, not ego satisfaction

Integration with broader financial goals:

For credit building: Use one card for small recurring charges, set autopay for statement balance, and let it build history passively while focusing on income growth and skill development.

For rewards optimization: Once you have positive cash flow and emergency savings, strategic card usage can enhance wealth building through rewards that get invested or reduce expenses.

For debt consolidation: Balance transfer cards serve as tactical tools when eliminating high-interest debt, but only with concrete repayment plans that address underlying spending issues.

The discipline requirement:

Credit cards amplify existing financial behaviors. Disciplined savers benefit through rewards and convenience. Undisciplined spenders accumulate high-interest debt. The tool is neutral—behavior determines outcomes.

Measuring credit card success:

Zero interest paid annually

Utilization below 30% (ideally below 10%)

100% on-time payment history

Net positive rewards after any fees

Credit score trending upward

No emotional stress about card balances

When to avoid credit cards entirely:

If you consistently carry balances, miss payments, or experience anxiety about credit card debt, the mathematical benefits don’t justify the psychological costs. Debit cards or cash-based systems may serve you better until spending discipline develops.

The compound effect:

Responsible credit card use over decades creates:

- Excellent credit scores (750+), enabling favorable rates

- Thousands in accumulated rewards

- Strong financial habits that extend beyond credit cards

- Access to premium cards with valuable benefits

Irresponsible use creates:

- Poor credit scores limit financial options

- Tens of thousands in interest payments

- Stress and limited financial flexibility

- Difficulty accessing credit when genuinely needed

Strategic principle: Credit cards should support your financial plan, not define it. Master cash flow, build savings, eliminate high-interest debt, and invest consistently. Then optimize credit card usage to enhance, not replace, sound financial fundamentals.

💳 Credit Card Interest Calculator

See the true cost of carrying a balance vs. paying in full

Your Payoff Analysis

⚠️ Key Insight: Paying your statement balance in full each month results in $0 interest charges. The calculations above show the cost of carrying balances—money that could be invested for compound growth instead.

Conclusion

Credit cards function as powerful financial tools when understood through the lens of mathematics, behavioral discipline, and strategic integration into broader financial planning.

The core principles:

Credit cards provide revolving credit access with grace periods that eliminate interest when statement balances are paid in full. This creates opportunities for rewards optimization, credit building, and payment convenience—but only when used with discipline and understanding.

The mathematics matter:

APR converts to daily interest rates that compound relentlessly on carried balances. Minimum payments trap borrowers in multi-decade debt cycles, costing double or triple the original borrowed amounts. Utilization ratios impact credit scores significantly, affecting access to favorable rates on major purchases.

The behavioral requirements:

Automation, monitoring, and rule-based decision-making eliminate emotional spending and prevent costly mistakes. Treating credit cards as payment tools rather than borrowing instruments maintains the mathematical advantages while avoiding the exponential costs.

The strategic integration:

Credit cards serve specific purposes within comprehensive financial plans—building credit history, optimizing rewards on necessary spending, and managing cash flow timing. They don’t replace emergency funds, investment strategies, or income growth as wealth-building priorities.

Your next steps:

- Audit current credit card usage: Calculate interest paid in the past 12 months, current utilization rates, and rewards earned

- Implement automation: Set up autopay for statement balances and balance alerts at 25% utilization

- Optimize card selection: Match cards to spending patterns or simplify to one or two cards that cover your needs

- Review monthly: Check statements for fraud, verify rewards, and ensure utilization stays optimal

- Build supporting systems: Emergency fund, budget tracking, and spending discipline that make credit cards enhancement tools rather than necessities

The fundamental truth:

Credit cards amplify existing financial behaviors. Master the fundamentals—spend less than you earn, save consistently, invest for compound growth—and credit cards enhance your financial efficiency. Neglect the fundamentals, and credit cards accelerate financial decline through high-interest debt and fee accumulation.

The math behind money reveals that credit cards are neutral instruments. Your understanding, discipline, and strategic usage determine whether they build or destroy wealth.

Related Guides

- Understanding credit card interest

- Managing card balances strategically

- Improving credit utilization ratios

- Choosing the right credit card

References

[1] Consumer Financial Protection Bureau. (2024). “Credit Cards and Credit Card Debt.” https://www.consumerfinance.gov/

[2] Federal Reserve. (2025). “Consumer Credit – G.19 Report.” https://www.federalreserve.gov/

[3] FICO. (2024). “What’s in Your Credit Score?” https://www.myfico.com/

[4] Consumer Financial Protection Bureau. (2024). “What is a credit card grace period?” https://www.consumerfinance.gov/

[5] Federal Reserve Bank of St. Louis. (2025). “Credit Card Interest Rate Data.” https://fred.stlouisfed.org/

Disclaimer

This article provides educational information about credit cards and is not financial advice. Credit card terms, interest rates, fees, and rewards structures vary by issuer and individual creditworthiness. Always read card agreements carefully before applying. Your financial situation is unique—consider consulting a qualified financial advisor for personalized guidance. The Rich Guy Math provides data-driven financial education but does not recommend specific financial products or guarantee particular outcomes. Credit card usage involves risks, including high-interest debt accumulation if balances are not managed responsibly.

About the Author

Max Fonji is the founder of The Rich Guy Math, a financial education platform dedicated to explaining the math behind money with precision and clarity. With a background in financial analysis and data-driven decision-making, Max translates complex financial concepts into actionable insights for investors and financial learners. His work focuses on evidence-based investing, risk management, and the quantitative frameworks that drive wealth building. Max’s educational approach combines analytical rigor with accessible teaching, helping readers understand not just what to do with money, but why the mathematics supports those decisions.

Frequently Asked Questions

Do credit cards build credit if you pay them off?

Yes—paying credit cards off in full actually builds credit more effectively than carrying balances. Payment history (35% of your credit score) records on-time payments whether or not you pay interest. Credit utilization (30% of your score) improves when balances remain low.

The belief that you must pay interest to build credit is a myth that costs consumers billions each year. Paying your statement balance in full every month builds credit while avoiding interest entirely.

Is it bad to use more than one credit card?

No—using multiple credit cards strategically can improve your credit score and increase rewards. Multiple cards raise your total available credit, which lowers overall utilization.

The key is manageability. Multiple cards work best if you can track balances, pay all statement balances in full, and keep utilization below 30% on each card. For most people, two to three cards provide optimal benefits without unnecessary complexity.

How many credit cards should I have?

Credit scoring models do not penalize having multiple cards—only how you use them. Data suggests that 3–5 credit cards provides the best balance between low utilization, rewards optimization, and ease of management.

Start with one or two cards, demonstrate responsible usage for 6–12 months, then add cards strategically based on spending habits and rewards opportunities.

Do rewards cards encourage overspending?

Research shows rewards programs can increase spending by 10–15% for some consumers due to psychological effects that make purchases feel discounted.

Rewards only become a problem if they cause spending you wouldn’t otherwise make. Budget first, then use rewards cards for planned expenses. If rewards drive new purchases, the costs often outweigh the benefits.

What happens if I only pay the minimum?

Paying only the minimum payment leads to three major consequences:

- Interest accrues at rates typically between 18% and 25% APR

- Interest compounds daily, increasing total debt

- Payoff timelines extend 20–30+ years

Example: A $5,000 balance at 20% APR with 2% minimum payments takes 447 months to repay and costs $18,560 in interest. Minimum payments maximize issuer profits while minimizing your financial progress.

Can I use credit cards for business expenses?

Yes—many freelancers and small business owners use credit cards for business expenses. Business credit cards offer advantages such as higher limits, business-specific rewards, and improved expense tracking.

Business cards may not affect personal credit utilization, but most require a personal guarantee. Regardless of card type, business expenses should always be tracked separately for tax purposes.

How long does it take to build good credit with a credit card?

Building good credit (700+ FICO score) typically takes 6–12 months of responsible use if starting with limited credit history.

Payment history strengthens immediately, utilization improvements can reflect within one billing cycle, and credit age improves over time. Rebuilding poor credit usually takes 12–24 months of consistent positive behavior.

Consistency matters more than time—six months of perfect payments is more powerful than years of inconsistent credit behavior.